Find out if we can save you money on your mortgage today

![]()

Rated Excellent by our customers

Types of mortgages

There are many different types of mortgage schemes available. Below is a summary of the main types and the advantages and disadvantages of each.

As highlighted some relate to the Bank of England interest rate and, if this rises or falls, it can have an impact on your mortgage repayments as our blog explains.

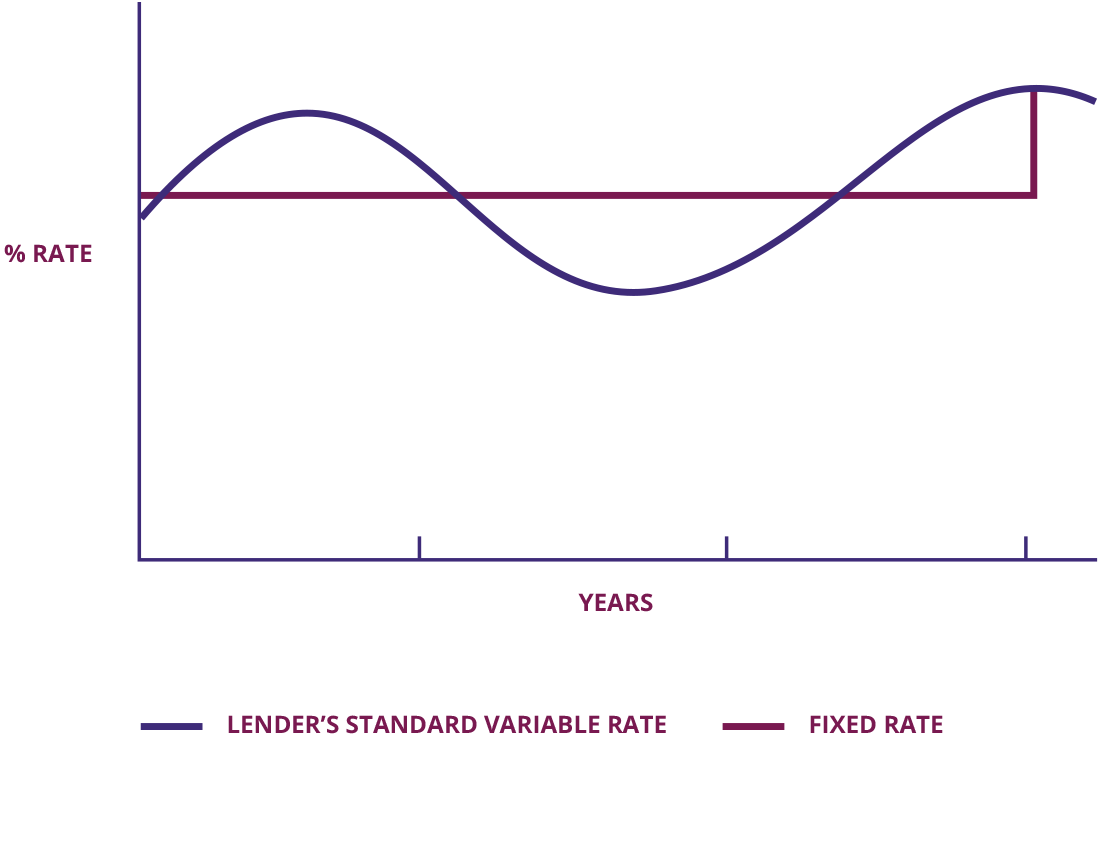

Fixed rate

The interest rate is fixed for a period of time. After this initial period it reverts to the lender's Standard Variable Rate.

Advantages:

Ability to budget - you know what you will be paying each month for the initial period.

Disadvantages:

Fixed only for an initial period not the whole mortgage term. If interest rates fall you could end up paying more than necessary. An arrangement fee may apply and an early repayment charge may be applied if the loan is redeemed before a specified date.

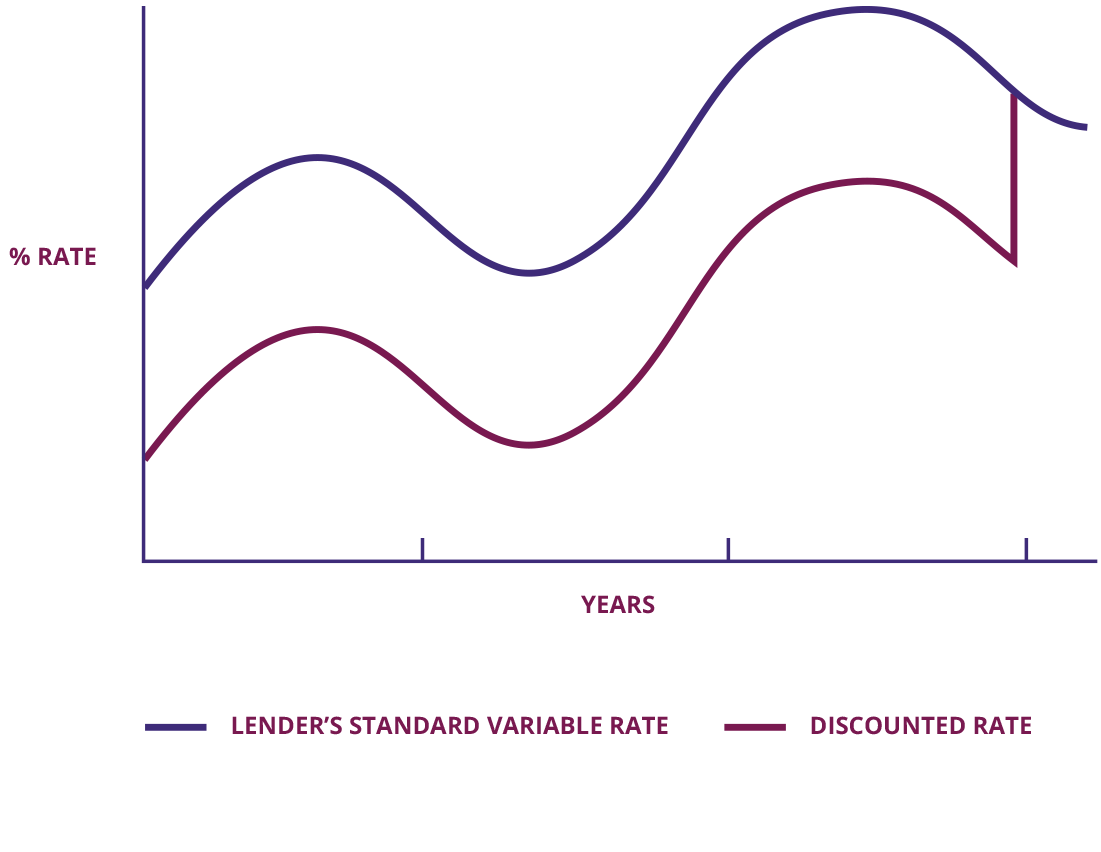

Discounted Rate

With a Discounted Rate mortgage the mortgage interest rate is reduced by a specified amount for a set period.

Advantages:

When the lender's Standard Variable Rate falls so do your monthly payments and it can provide lower monthly mortgage payments at the start of the mortgage.

Disadvantages:

An arrangement fee may apply and an early repayment charge may be applied if the loan is redeemed before a specified date. Less easy to budget than with a fixed rate mortgage.

Standard Variable Rate

This is the normal rate charged by the lender without any discounts or special deals. It can be changed by the lender in line with market conditions. This is usually the interest rate that a lender will revert to once the initial deal has finished.

Advantages:

Often no early repayment charges.

Disadvantages:

Often higher rate than fixed / tracker / discounted mortgages.

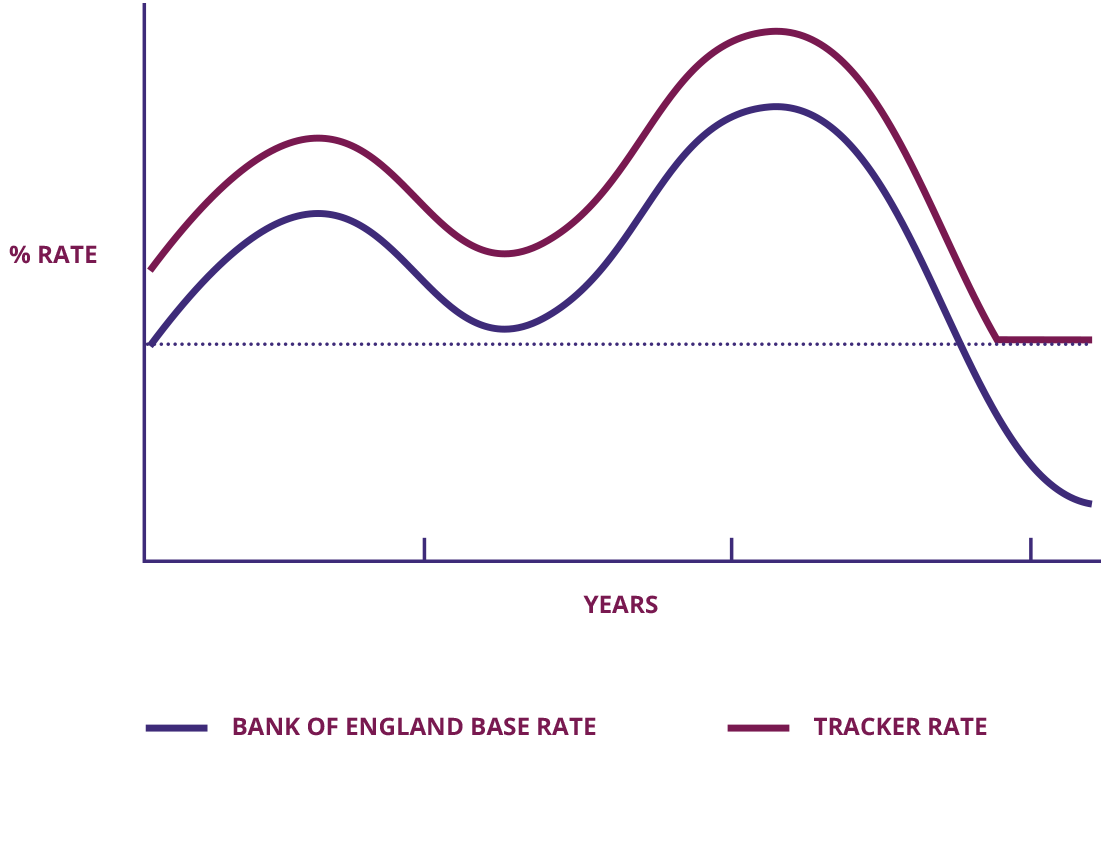

Tracker Rate

The interest rate on your mortgage moves up and down with a particular base rate, such as the Bank of England base rate.

Advantages:

When the index (for example, the Bank of England base rate) falls, so will your monthly payments.

Disadvantages:

If the Bank of England rate goes up, so do your monthly payments. Often a minimum percentage is specified. An arrangement fee may apply and an early repayment charge may be applied if the loan is redeemed before a specified date. Less easy to budget for than with a fixed rate mortgage.

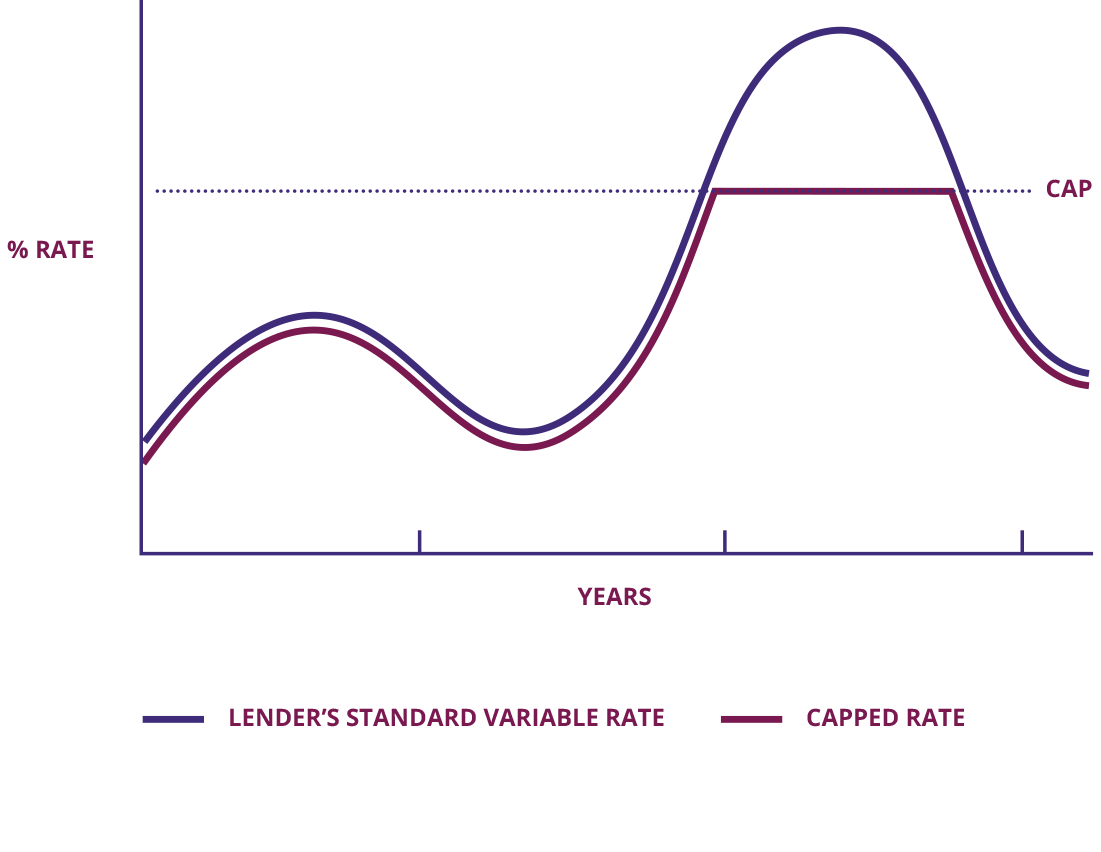

Capped mortgage

The interest rate follows the lender’s Standard Variable Rate (SVR) but there is a maximum interest rate you have to pay.

Advantages

- If rates go up you only have to pay up to the ‘ceiling’ interest rate

- If the lender’s SVR falls, your monthly payments will decrease

Disadvantages

- Tend to be more expensive than Fixed or Tracker Mortgages

- Not as easy to budget for as your monthly payments

go up and down, although there is a ceiling as to how much they can increase - May include an arrangement fee and early repayment charges